A study by VISA on the spending habits and payment preferences revealed insightful areas for banks and merchants [and even brands] to make their business models more Millennial-friendly.

Over 1,000 Millennials (18-34 years old) and Non-Millennials (34+ years old) across KSA and UAE were interviewed, revealing that Millennials are the fastest growing, influential and increasingly affluent group in the UAE and KSA.

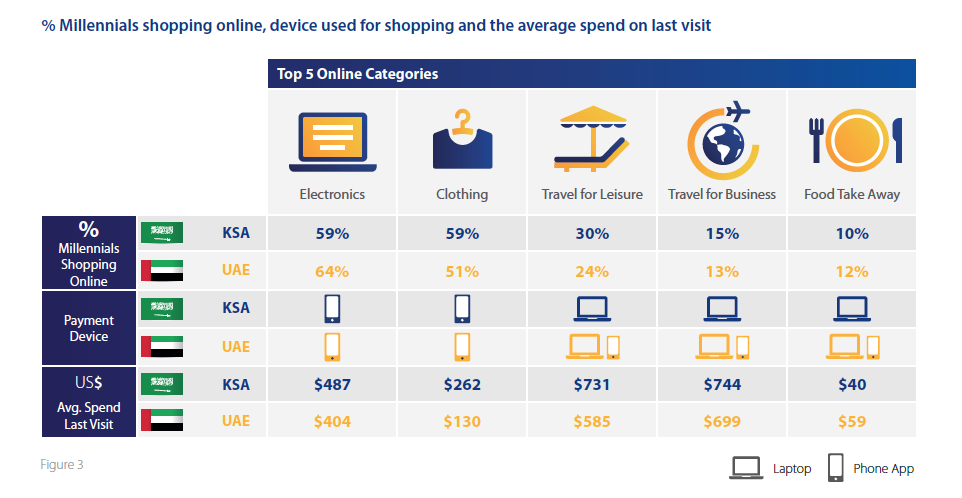

They are actively online between 4.5 and 6.5 hours a day, and have fully embraced online payments. eCommerce is by far the most popular activity, with 76% of UAE millennials shopping online, while approximately half currently pay their bills online.

They are also higher spenders than their peers. This is significant for brands to focus on because:

Here are some of the key findings:

The VISA study shows that while Millennials in the UAE prefer travel miles and cash-back, they are dissatisfied with what they get from their payment cards.

To get a cross-section into what they would prefer instead, we talked to a few people in the UAE in the 18-34 bracket and found that there is a demand for meaningful and personalized lifestyle-related reward programs with significant flexibility.

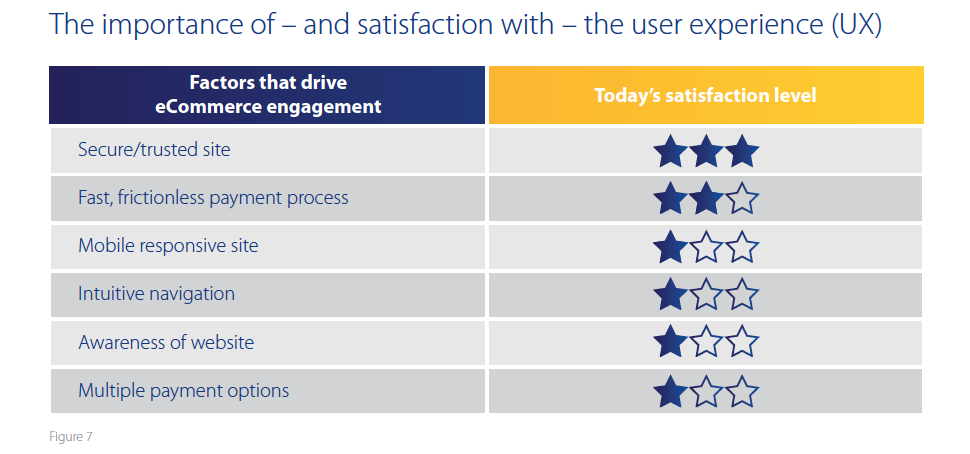

While more than 50 percent of Millennials in the UAE and KSA prefer to bank digitally, they are frustrated by the user experience.

The study suggests that the frustration experienced is due to lack of personalization, cross-platform information channels [because Millennials like to get all their account information and track it without hassle], and insufficient real-time alerts.

Millennials in the UAE, and elsewhere, are digital one-click creatures who have multiple tabs open on any device they’re using. For this segment, having tiresome verification processes for online payments, or difficulty setting up accounts means lost business for a bank.

Social media is driving eCommerce purchase decisions for segment

So, why are Millennials looking things up online? Perhaps, it’s because the word of mouth credibility that came to Non-Millennials in person has found its home on social media. An active social media presence indicates to a Millennial that the brand will provide real-time customer care, while the peer reviews add a social element of influence.

Here’s Sherouk Zakaria, a young UAE Resident, on the matter:

It’s because social media represents sincere opinions of regular people and other fellow customers.

By 2018, credit cards predicted to account for 65% of UAE non-cash retail payment volumes.

In the UAE, credit cards are the preferred way to pay for all major online categories. Why?

Convenience.

A copy of “Understanding the Millennial mindset – and what it means for payments in the GCC” is available via visanewsmena.tumblr.com

Don’t miss: A Day in the Life of a Dubai Radio Presenter, Changing Career Paths: Here’s What You Need To Know

![Social alienation is a sharp tactic in the toolkit of domination [although, here it is the extension of female subordination]. Photo by Hans Van Den Berg/ flickr.com](https://b-change.me/wp-content/uploads/2018/01/1sTnAkZgJEx1Yb6fctMyVuA-570x300.jpeg)